Free Printable Savings Tracker: Track Your Finances and Achieve Your Goals

Welcome to the world of free printable savings trackers! In this engaging introduction, we will explore the benefits of using a savings tracker, how it can help you stay motivated and organized, and provide tips on using it effectively. So, let’s dive in and take control of your financial journey!

Introduction to a free printable savings tracker

A savings tracker is a tool that helps individuals keep track of their savings progress. It provides a visual representation of how much money has been saved and how close they are to reaching their financial goals. Using a savings tracker can have several benefits, including:

1. Increased motivation

Seeing the progress made towards a savings goal can be highly motivating. It provides a sense of accomplishment and encourages individuals to continue saving.

2. Better organization

A savings tracker helps individuals stay organized by keeping all their savings information in one place. It allows them to easily monitor their savings and identify any areas where adjustments may be needed.

3. Financial awareness

Tracking savings provides a clear picture of one’s financial situation. It helps individuals understand where their money is going and identify opportunities for saving more effectively.Using a printable savings tracker is a convenient way to monitor savings progress. It allows individuals to have a physical copy that can be easily updated and referred to.

Here are some tips on how to use a printable savings tracker effectively:

Set clear savings goals

- Before using a savings tracker, it’s important to set clear savings goals. Determine how much money you want to save and the timeframe in which you want to achieve it.

- Break down your goals into smaller milestones. This will make them more achievable and help you stay motivated along the way.

Track your savings regularly

- Make it a habit to update your savings tracker regularly. This will give you a clear picture of your progress and help you stay on track.

- Set a specific day or time each week to update your tracker and review your savings.

Celebrate milestones

- When you reach a savings milestone or achieve a goal, take the time to celebrate your progress. This will provide a sense of accomplishment and motivate you to continue saving.

- Consider rewarding yourself with a small treat or doing something you enjoy without compromising your overall financial goals.

Make adjustments as needed

- Regularly review your savings tracker to identify any areas where adjustments may be needed. If you’re falling behind on your goals, look for ways to cut expenses or increase your income.

- Be flexible and willing to make changes to your savings plan as circumstances change.

By using a printable savings tracker effectively, you can stay motivated, organized, and on track to achieve your financial goals.

If you’re looking for coloring pages thanksgiving printable, we’ve got you covered! Thanksgiving is a time for family, food, and gratitude. Our collection of coloring pages captures the spirit of this special holiday. From turkeys to pumpkins to cornucopias, our coloring pages thanksgiving printable feature a variety of Thanksgiving-themed designs that you can print and color.

Coloring can be a fun and creative way to celebrate Thanksgiving with your family. It’s a great activity to keep the kids entertained while you’re preparing the Thanksgiving feast. So why not gather around the table, grab some coloring pencils, and start coloring!

Features of a free printable savings tracker

A free printable savings tracker offers various features to help individuals manage their finances effectively. These features include:

1. Income Tracking

Keeping track of your income is an essential element of a savings tracker. It allows you to monitor your earnings from various sources such as salary, freelance work, or investments. By recording your income accurately, you can have a clear overview of your financial inflow.

2. Expense Tracking, Free printable savings tracker

Tracking your expenses is crucial for understanding where your money is going. A printable savings tracker allows you to record and categorize your expenses, such as bills, groceries, transportation, and entertainment. By monitoring your expenses, you can identify areas where you can cut back and save more.

3. Savings Goal

Setting a savings goal is an important step in achieving financial stability. A savings tracker provides a dedicated section to define your savings goal, whether it’s for a specific purchase, emergency fund, or long-term investment. This feature helps you stay focused and motivated to reach your target.

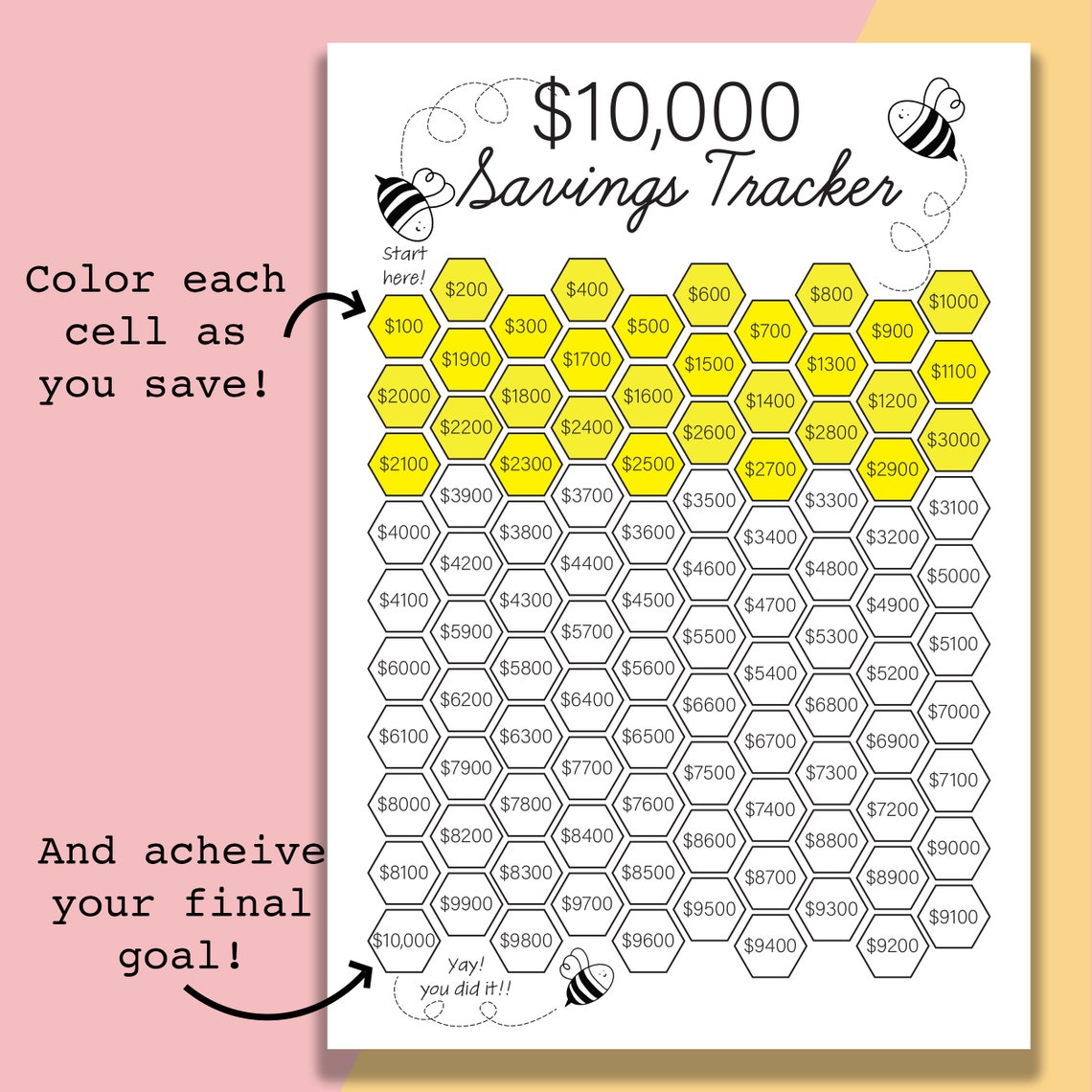

4. Progress Tracking

A printable savings tracker enables you to track your progress towards your savings goal. It typically includes a visual representation, such as a progress bar or chart, that shows how close you are to achieving your target. This feature allows you to celebrate milestones and make adjustments if necessary.

5. Different Formats and Designs

Printable savings trackers come in various formats and designs to suit different preferences. Some templates may have a monthly layout, while others may have a yearly overview. Additionally, you can choose between minimalist designs or more visually appealing ones. Selecting a format and design that resonates with you can enhance your motivation to use the tracker consistently.

6. Customization Options

One of the advantages of a printable savings tracker is the ability to customize it according to your personal financial needs. You can add or remove categories, modify the layout, or include specific sections that are relevant to your saving journey.

Customizing the tracker ensures it aligns with your unique financial situation.

7. Popular Printable Savings Tracker Templates

There are numerous popular printable savings tracker templates available online. These templates provide a starting point for individuals who prefer a pre-designed layout. Some popular options include the bullet journal style, vertical or horizontal layouts, and templates with motivational quotes or illustrations.

Exploring these templates can give you inspiration for creating your own personalized savings tracker.Remember, the key to effective savings tracking is consistency and regular updates. Find a printable savings tracker that suits your needs and commit to using it consistently.

With dedication and discipline, you can achieve your financial goals and build a strong foundation for your future.

Benefits of using a free printable savings tracker

Using a free printable savings tracker offers several advantages that can greatly enhance your financial management and help you achieve your financial goals. Let’s explore some of these benefits below.By tracking your savings, you can increase your financial awareness and discipline.

It allows you to have a clear picture of your progress towards your savings goals, making you more conscious of your spending habits and financial decisions. The act of actively monitoring your savings can motivate you to make better choices and stay on track with your financial plans.A

savings tracker can also help you identify areas of overspending or potential cost-cutting measures. By closely monitoring your expenses and savings, you can pinpoint areas where you are spending more than necessary. This awareness allows you to take proactive steps to reduce unnecessary expenses and redirect those funds towards your savings.

It enables you to make informed decisions about your spending habits and adjust them accordingly.One of the most inspiring aspects of using a savings tracker is the success stories of individuals who have achieved their financial goals through diligent tracking.

If you’re looking for free printable coloring pages butterflies, you’re in luck! We have a great collection of butterfly coloring pages that you can print and color at home. Whether you’re a kid or an adult, coloring can be a fun and relaxing activity.

It allows you to express your creativity and improve your focus. Our free printable coloring pages butterflies feature a variety of butterfly designs, from simple to intricate. You can choose your favorite design and use your favorite colors to bring these beautiful creatures to life.

So grab your coloring pencils and start coloring!

These stories serve as a powerful motivation and demonstrate that with discipline and consistent tracking, financial milestones can be reached. Reading about these success stories can give you the confidence and determination to continue tracking your savings and work towards your own financial aspirations.Consistently

using a savings tracker also has long-term benefits. It not only helps you achieve short-term goals but also cultivates a habit of saving and responsible financial management. This habit can have a positive impact on your financial well-being in the long run.

By tracking your savings consistently, you develop a mindset focused on saving and achieving financial stability. This can lead to better financial decision-making, increased savings, and a more secure financial future.In conclusion, using a free printable savings tracker offers numerous benefits that can significantly improve your financial awareness, discipline, and decision-making.

It helps you identify areas of overspending, provides inspiration through success stories, and cultivates a habit of consistent savings tracking with long-term benefits. Start using a savings tracker today and take control of your financial journey.

Tips for finding and using a free printable savings tracker

Finding a suitable and reliable free printable savings tracker can greatly assist in managing your finances and achieving your savings goals. Here are some tips to help you find and effectively use a printable savings tracker.

1. Reputable websites or platforms

When searching for a free printable savings tracker template, it is important to rely on reputable websites or platforms. Some popular options include:

- Personal finance blogs: Many personal finance bloggers offer free printable savings trackers on their websites. These bloggers often share their own experiences and tips, making their templates valuable resources.

- Financial planning websites: Websites that specialize in financial planning and budgeting tools may offer free printable savings trackers as part of their resources. These websites are dedicated to helping individuals effectively manage their finances.

- Online communities: Joining online communities focused on personal finance can provide access to shared resources, including free printable savings trackers. These communities allow individuals to learn from and support one another.

2. Selecting a tracker that suits your preferences and needs

It is important to select a printable savings tracker that aligns with your preferences and needs. Consider the following factors:

- Design and layout: Choose a tracker that visually appeals to you and is easy to navigate. A well-designed tracker can make the tracking process more enjoyable and motivate you to stay on top of your savings goals.

- Categories and customization: Look for a tracker that offers categories relevant to your financial goals. Additionally, consider whether the tracker allows for customization, such as adding or modifying categories to suit your specific needs.

- Compatibility: Ensure that the printable savings tracker is compatible with the software or apps you use for managing your finances. This will allow for seamless integration and streamline your tracking process.

3. Effectively utilizing a printable savings tracker

To make the most of a printable savings tracker, consider the following tips:

- Set clear savings goals: Before using the tracker, establish specific savings goals. This will help you stay focused and motivated throughout the tracking process.

- Consistent tracking: Regularly update the tracker with your income, expenses, and savings. Consistency is key to accurately monitoring your progress and identifying areas for improvement.

- Review and analyze: Periodically review your tracker to assess your financial habits and identify patterns. This will enable you to make informed decisions and adjust your savings strategies accordingly.

- Celebrate milestones: Celebrate your achievements along the way. When you reach significant milestones or savings targets, reward yourself to maintain motivation and reinforce positive financial habits.

4. Overcoming potential challenges

Using a savings tracker may come with its own challenges. Here are some potential challenges and how to overcome them:

- Tracking inconsistencies: It can be easy to forget to update the tracker regularly. Set reminders or establish a routine to ensure consistent tracking.

- Unexpected expenses: Life is unpredictable, and unexpected expenses may arise. Adjust your savings goals and budget accordingly to accommodate these expenses without discouraging your progress.

- Lack of motivation: Sometimes, it can be challenging to stay motivated throughout your savings journey. Find ways to keep yourself motivated, such as visualizing your financial goals or seeking support from friends or online communities.

By following these tips, you can find a reliable free printable savings tracker and effectively utilize it to track your savings progress, improve your financial habits, and achieve your financial goals.

Alternatives to a Free Printable Savings Tracker

While a free printable savings tracker can be a useful tool for managing your finances, there are also digital alternatives available that offer their own set of benefits. In this section, we will explore some of the digital savings tracking apps and software options, discuss their advantages and disadvantages compared to printable trackers, provide recommendations for those who prefer digital methods, and explore the potential integration of printable and digital tracking methods for optimal results.

Digital Savings Tracking Apps or Software Options

In today’s digital age, there are numerous savings tracking apps and software programs that can help you effectively manage your finances. These tools offer a range of features and benefits that make tracking your savings more convenient and efficient.

- Mobile Apps:Many banks and financial institutions offer mobile apps that allow you to track your savings directly from your smartphone or tablet. These apps often provide real-time updates on your account balance, allow you to set savings goals, and offer budgeting tools to help you stay on track.

- Web-based Tools:There are also web-based tools and software programs available that can be accessed from any device with an internet connection. These tools offer similar features to mobile apps, allowing you to track your savings, set goals, and manage your finances from the convenience of your computer.

- Specialized Savings Apps:In addition to banking apps and software, there are also specialized savings apps available that are designed specifically for tracking and managing your savings. These apps often offer additional features such as expense tracking, bill reminders, and investment tracking.

Benefits and Drawbacks of Digital Tools

Using digital tools for savings tracking offers several advantages over printable trackers, but there are also some drawbacks to consider.

- Advantages:

- Convenience: Digital tools allow you to track your savings on the go, anytime and anywhere.

- Real-time Updates: With digital tools, you can receive real-time updates on your account balance and track your progress towards your savings goals.

- Automation: Many digital tools offer automation features that can help you save more efficiently, such as automatic transfers to your savings account.

- Data Analysis: Digital tools often provide data analysis and insights that can help you identify spending patterns, make informed financial decisions, and optimize your savings strategy.

- Drawbacks:

- Security: While digital tools have advanced security measures in place, there is always a risk of data breaches or unauthorized access to your financial information.

- Dependence on Technology: Digital tools rely on technology and internet connectivity, so if there are technical issues or you don’t have access to the internet, you may not be able to track your savings effectively.

- Learning Curve: Using digital tools may require some time to learn and navigate the interface, especially if you are not familiar with technology.

Recommendations for Digital Tracking Methods

If you prefer digital methods for tracking your savings, here are some recommendations:

- Research and compare different savings tracking apps and software options to find the one that best suits your needs and preferences.

- Read reviews and user feedback to get an idea of the user experience and reliability of the digital tools you are considering.

- Ensure that the digital tool you choose has robust security measures in place to protect your financial information.

- Take advantage of the features offered by digital tools, such as setting savings goals, automatic transfers, and data analysis, to optimize your savings strategy.

- Regularly update and review your savings tracking app or software to ensure that it aligns with your current financial goals and circumstances.

Potential Integration of Printable and Digital Tracking Methods

While digital tools offer convenience and automation, printable savings trackers can still be a valuable supplement to your savings tracking routine. Consider integrating both methods for optimal results:

- Use a printable savings tracker for a visual representation of your savings progress and to easily jot down any additional notes or reminders.

- Combine the data from your printable tracker with the insights and analysis provided by your digital tool to gain a comprehensive view of your savings habits and make informed financial decisions.